My electricity usage over time. I track many things to monitor my inflation versus the CPI.

Saturday, June 15, 2024

My electricity bills over time (June, 2024 Edition)

Thursday, June 13, 2024

PPI June 2024 release with May 2024 Data

The BLS has released the May, 2024 Producer Price Index Report. (historical releases)

The Producer Price Index for final demand declined 0.2 percent in May, seasonally adjusted, the U.S. Bureau of Labor Statistics reported today. Final demand prices increased 0.5 percent in April and edged down 0.1 percent in March. (See table A.) On an unadjusted basis, the index for final demand advanced 2.2 percent for the 12 months ended in May.

The May decrease in final demand prices can be attributed to a 0.8-percent decline in the index for final demand goods. Prices for final demand services were unchanged.

Prices for final demand less foods, energy, and trade services were unchanged in May following a 0.5-percent increase in April. For the 12 months ended in May, the index for final demand less foods, energy, and trade services rose 3.2 percent.

PPI Final Demand...

Wednesday, June 12, 2024

BLS Data Dump. Real Earnings - June 12th, 2024

On to the Real Earnings.

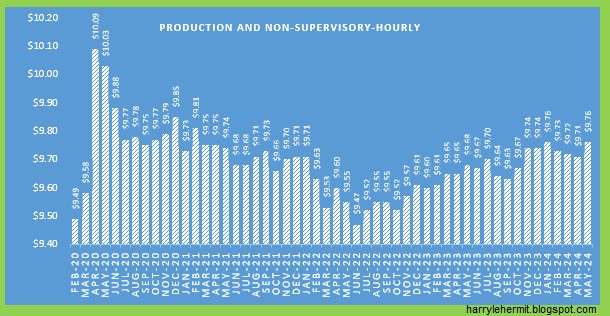

Finally an uptick in real earnings. Depending on when you consider turmoil in the labor market, due to covid, the hourly rate is either 13¢ or 1¢ above that period.

BLS Data Dump. CPI - June 12th, 2024

First up is the BLS Report for CPI...(historical releases)

The Consumer Price Index for All Urban Consumers (CPI-U) was unchanged in May on a seasonally adjusted basis, after rising 0.3 percent in April, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 3.3 percent before seasonal adjustment.

More than offsetting a decline in gasoline, the index for shelter rose in May, up 0.4 percent for the fourth consecutive month. The index for food increased 0.1 percent in May. The food away from home index rose 0.4 percent over the month, while the food at home index was unchanged. The energy index fell 2.0 percent over the month, led by a 3.6-percent decrease in the gasoline index.

Here is the unadjusted CPI for the past 12 months...

This Week in Petroleum Summary June 12th, 2024 per EIA.GOV

This week's full report.

Gasoline fell -4.9¢ for the week, and is now below year ago levels, by -14¢, or -3.9%. Consumption edged up... per this past report, yet still remains below year ago levels, bu -2.3%.

Wednesday, June 5, 2024

This Week in Petroleum Summary June 5th, 2024 per EIA.GOV

This week's full report.

Gasoline fell -7.2¢ for the week, and is now below year ago levels, by -4.9¢, or -1.4%. Consumption slipped... per this past report, and remains below year ago levels.

Sunday, June 2, 2024

A Foray into the 2024 Presidential Election, Part XVII

The race is tightening a bit on the national level, with Trump edge of 0.7% from two weeks ago, now standing at 0.2%. This is tighter than fivethirtyeight, which has the Trump edge a 1.3%.

The current comparison to same time four years ago...

A FEW CHARTS WITH SOME POLITICS - January 07, 2026

The crude inventories are in good shape for this time of year... It should be noted that the total inventory of Petroleum and Petroleum prod...

-

Reviewed this weeks EIA report and observed the current status of inventories. Oddly, although domestic consumption is down from last year,...

-

This week's full report . Gasoline pump prices rose +1.4¢ for the week, but continues below year ago levels, by -3.2¢, or -1.2%. Days...

-

Today's EIA.gov report . Crude stocks up again, +7.6M barrels, from last week; Distillates up +2.7M Barrels; and Gasoline slid -1.9M b...