I've had to revise downward, my previous forecast... by quite a bit. I am okay with that, as longing for inflation to continue upward, with the hopes of a higher check in the future... seems rather silly, imo.

While headline CPI was 0% for the month to month, the CPI-W declined -0.1%. Both were largely a product of the decline in energy, specifically gasoline. Gasoline has already fallen on this date, by similar numbers as July. Which will be more than enough to offset the rise in groceries (more later on groceries). Gasoline should fall a bit further over the next week, but seems to be set to stabilize.

It might even offset any expected increases in "core" inflation. My August projection in the chart is for a range of -0.2% ~ +.01% month to month for CPI-W. September CPI-W ranges from -0.3% ~ 0.0%. So while the chart plots the C.O.L.A. increase range as 8.6%~9.0%, the lower number is much more likely, imo.

So call me suspicious of "non-partisan" groups that have headlined the potential for 10%+ S.S.A. C.O.L.A. and their adoring "journalists" that published this information for seniors on Social Security to read. To get 10%+, you have to have at least one month above 10% and likely 2. We haven't had even one.

It does make me wonder what the aim of those "reports" were? Further divisions? Which brings me to politics. One side of the aisle plays up the 0.0% change in M/M and the other side reminds us, it is still 8.5% Y/Y.

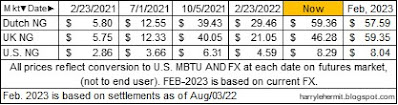

I may sound like the latter, given what I am about to say. But first, another chart (BLS sourced, except projections)...

When I earlier mentioned a near repeat of July's numbers for August, I was not kidding. Which brings me to food... something I rather enjoy. It also brings up the looming food insecurity and a phenomena called "hangry" . The latter of which is a smash-up of hungry and angry.

August's food at home will most likely be +14.3% Y/Y. How can I say this? This is the PPI (BLS) from July and while it was down -0.5%, that did not mean everything went down. NO! It did not!

Somehow I believe, some of this will get passed on. It is already an issue on the websites I frequent, just as gasoline prices were. Were, as in it has shifted to lower pump prices, but still unhappy, as it isn't what it was 1 year or 2 years ago. So remember the 2.0% finished consumer goods, one month jump of the PPI. It is coming to a home near you.

Food is becoming more and more the topic, with many expressing some form of hardship. What intrigues me, is they are still hanging on to their smart phones, internet connections, etc.

However, there are people that either haven't had any of those items or have had to cut back. People do change their spending habits for one reason or another, but keeping food on the table is rather constant, imo.

I am referring to the USA in this instance, as I cannot imagine the hardships being foisted on a large swath of the population in Europe. And as food is a global commodity... the rest of the world as well. Seriously, I cannot fathom what it is like in some areas of Africa where food scarcity is the issue.

Food scarcity... lack of basic nutritional food.

Food insecurity... inability to afford basic nutritional food.

We have enough angry people in the USA, without increasing food insecurity and making even more people angry or hangry.

Which goes to show a tried and true historical method is once again being used. Our "elected leaders", "corporate masters", and their "media shills" must ensure we are blaming each other, rather than focusing on the real problem... which is "them".

I'm sure we will be informed how things are "looking up" or the "sky is falling". Most likely all spin, just like water circling the drain.

Whew! I got that off my chest! Time for a nap?