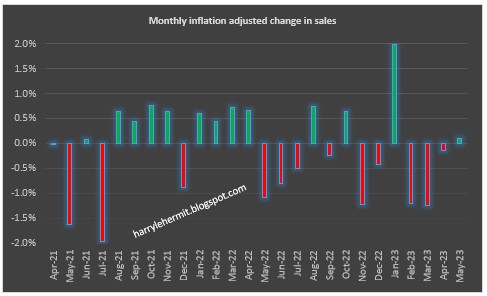

The BLS report was released this morning and it was a shade below consensus estimates. (historical releases)

The Consumer Price Index for All Urban Consumers (CPI-U) rose 0.1 percent in May on a seasonally adjusted basis, after increasing 0.4 percent in April, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 4.0 percent before seasonal adjustment.

The index for shelter was the largest contributor to the monthly all items increase, followed by an increase in the index for used cars and trucks. The food index increased 0.2 percent in May after being unchanged in the previous 2 months. The index for food at home rose 0.1 percent over the month while the index for food away from home rose 0.5 percent. The energy index, in contrast, declined 3.6 percent in May as the major energy component indexes fell.

I read some reports how inflation came in well below expectations. Apparently those expectations got inflated prior to this release. The expected inflation Y/Y was 4.13% and this report came in at 4.048%.

It goes without saying that energy costs going down is a major factor in these lower inflation rates.

Yes, today's release is the lowest since March, 2021. However, the period since that date has seen overall prices increase 14.82% in that 26 month period. Which matches the rise of prices from August, 2012 until March, 2021. A period of 103 months.

Here is some food for thought. Food at home, has risen 19.5% in the 26 months, since March, 2021. It rose 19.5% from May, 2008, until March, 2021... a period of 102 months.

Those stats are a bit hard to chew.

So yes, inflation is slowing and should continue to slow. But once again, without the energy component, and the food component... prices increased 5.3%. Food was generally flat for the month, but still up 5.8% Y/Y.

My own personal CPI...

The current report card...

It is down across the board and hopefully... will continue to slide.