Some ups and some down in the latest release from the BEA. (red revised down, green revised up).

Chained dollar disposable income was revised down for April and June, with a negative print on July.

However, the chained dollar PCE was revised down for March and May, with upward revisions in April and June.

It seems evident that savings AND debt are currently driving the economy. How long that can last is the big question.

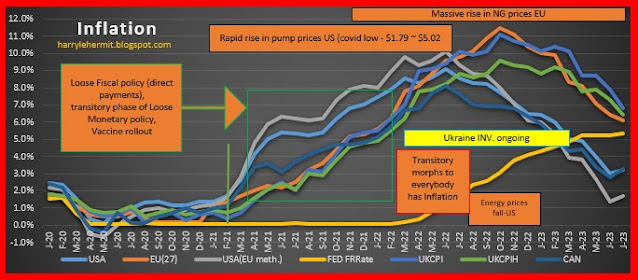

Then there is the matter of PCE Excluding Food & Energy. If the target is 2%, then there is a way to go, given the forecast for August is at 4%. Years ago, when the PCE ex food and energy was failing to achieve even 2%, there was discussion of moving the target to 4%.

That hasn't happened, so how can it be expected for the FED to ease off the interest rates?

|

| https://www.bea.gov/news/2023/personal-income-and-outlays-july-2023 |

We are now 28 months with the PCE ex food and energy above the 2% mark, and 17 months into the FED increasing rates. 10 months out, with the aforementioned halting its rise.

The chart below indicates some problems still within the system. Last month had just one category in pink.

We are at the end of August and its data will likely be similarly ugly. Let's hope for some relief in September.