This week's full report.

Wednesday, January 31, 2024

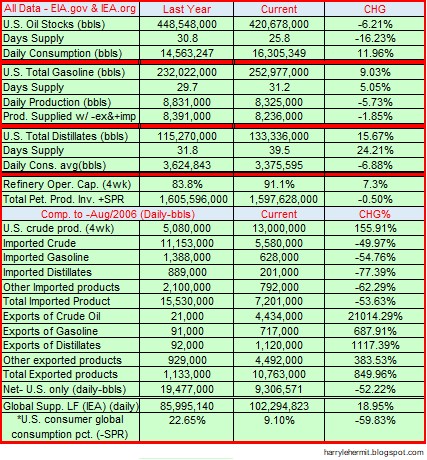

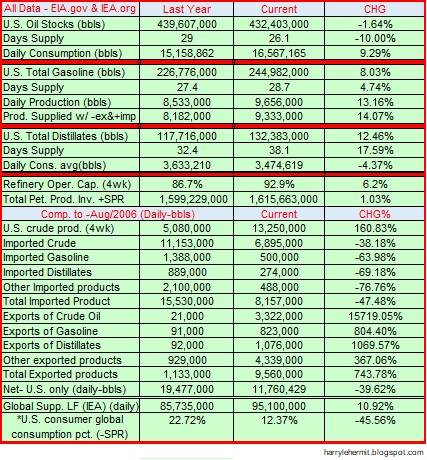

This Week in Petroleum Summary January 31st, 2024 per EIA.GOV

Monday, January 29, 2024

Review of December 2023 data, 4Q GDP, PCE and personal income

Alas, 2023 reports have concluded. The GDP's 4Q advance reading indicates a sterling 3.1% rise. I will make mention of the 5 year Quinquennial revision from 2012 dollars to 2017 dollars. As would be expected the numbers jumped 9.0%. I can't help but notice the big drag on GDP of net exports of good and services, slid a whopping -26.7%.

Even under the revised numbers, that latter component fell another -5.9% from one year ago.

Wednesday, January 24, 2024

This Week in Petroleum Summary January 24th, 2024 per EIA.GOV

This week's full report.

Saturday, January 20, 2024

My electricity bills over time (January, 2024 Edition)

It is January, and the monthly bill has arrived.

Friday, January 19, 2024

Comparison of Inflation in selected countries- January, 2024 Edition

With the United Kingdom, Canada and EUstats release of December data, I have updated my comparison graph. [Note, the USA(EU method) is directly from Eurostat.]

Long before inflation was everywhere, the phrase was transitory. Yes Virginia, the USA led that "transitory" inflation, until the rest of the world started catching up.

The chart is quite "busy", but the timeline is quite accurate.

'nuff said!

Thursday, January 18, 2024

This Week in Petroleum Summary January 18th, 2024 per EIA.GOV

This week's full report.

Wednesday, January 17, 2024

1/17/2024, Advance Retail Sales Report for December Data

Advance Monthly Sales for Retail and Food Services, December Report.

Advance estimates of U.S. retail and food services sales for December 2023, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $709.9 billion, up 0.6 percent (±0.5 percent) from the previous month, and up 5.6 percent (±0.7 percent) above December 2022. Total sales for the 12 months of 2023 were up 3.2 percent (±0.4 percent) from 2022. Total sales for the October 2023 through December 2023 period were up 3.9 percent (±0.4 percent) from the same period a year ago. The October 2023 to November 2023 percent change was unrevised from up 0.3 percent (±0.3 percent)*.

Hmmm... "Total sales for the 12 months of 2023 were up 3.2 percent (±0.4 percent) from 2022." The BLS listed that same period as having inflation of 3.4%. Which means the seasonal variation and trading-day differences have come into the equation. Otherwise, sales were up a bit more than indicated, imho.

First up the revisions...

We continue a pattern of previous months being revised downward, so the monthly changes are somewhat suspect.

When adjusted for inflation, the annual shows an improvement of +2.2%. The January numbers will be quite interesting, imho. The January report, adjusted for inflation, is slightly above the December number with inflation adjustements. Revisions will likely take place. 😒

The inflation adjusted chart looks like this...

Friday, January 12, 2024

Producer Price Index January release December 2023 Data

The BLS has released the December Producer Price Index Report. (historical releases)

The Producer Price Index for final demand fell 0.1 percent in December, seasonally adjusted, the U.S. Bureau of Labor Statistics reported today. Final demand prices moved down 0.1 percent in November and 0.4 percent in October. (See table A.) On an unadjusted basis, the index for final demand rose 1.0 percent in 2023 after increasing 6.4 percent in 2022.

If the PPI is really a forerunner of consumer inflation, then CPI should continue to ease, as PPI has nearing same rate as CPI in the periods outlined below.

Thursday, January 11, 2024

A Foray into the 2024 Presidential Election, Part IX

I previously posted that unless the EVs changed, I would attempt to avoid posting. They have changed.

The main change was Pennsylvania easing a bit from the (R) candidate. Simply put... the polls indicate a slight edge to DEM, but historically has under-reported REP votes in general elections, by 3%. Even with that latter adjustment, the result falls into the margin of error.

BLS Data Dump. CPI - January 11, 2024

First up is the BLS Report for CPI...(historical releases)

Not sure what the hoopla is about, regarding coming in hotter than expected. Factoring the rounding, it was just a few basis points above my expectations.

The index for shelter continued to rise in December, contributing over half of the monthly all items increase. The energy index rose 0.4 percent over the month as increases in the electricity index and the gasoline index more than offset a decrease in the natural gas index. The food index increased 0.2 percent in December, as it did in November. The index for food at home increased 0.1 percent over the month and the index for food away from home rose 0.3 percent.

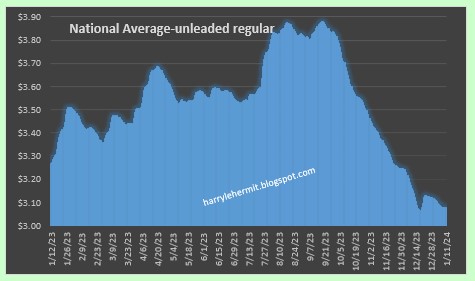

I highlighted a portion of that statements, as it is weird as heck. Gasoline in the November report was 297.598 and December gave a 280.289. Granted that is "unadjusted", but seriously... where did the increase in gasoline index come from? Nationally, the prices are down from last month, about 18¢ and down about 9¢ from December of 2022. Yet, somehow the "seasonally adjusted" edged up enough to offset something else.

Even by the BLS numbers from December, 2022... gasoline fell -1.5% (unadjusted) on the month and was -9.4% on the seasonal adjustments. December, 2023... saw gasoline fall -1.9% on the unadjusted monthly, ... but rose +0.2 of the seasonal adjustments.

In any case, the top number has decreased for 3 consecutive months. Now that would be seasonal, as November and December of 2022... saw decreases. It reversed in the January 2023 report.

This Week in Petroleum Summary January 11th, 2024 per EIA.GOV

This week's full report.

Friday, January 5, 2024

A Foray into the 2024 Presidential Election, Part VIII

Texas seems to be in the toss-up column, although not sure why. This is somewhat due to the tendency of polls to slightly understate the democrat votes. Still, the state falls into republican territory quite comfortably. Now it is R-189 and D-203.

Florida is next up and the polls for the state, tend to slightly overstate the democrat support, while understating the republican support. Thus Florida with its 30 EVs moves the needle to R-219 and D-203.

Virginia (13) keeps getting into the toss-up category. It puzzles me as to why, as it will very likely vote the democrat candidate and has a stellar polling v result score, imo. Thus R-219 and D-216.

I will lump Arizona (11) and Georgia (16) together, as they both have been consistently correct in polling matching outcomes. Polls seem to indicate a fairly strong republican tendency, which translates to R-246 and D-216.

Might as well get Wisconsin (10) out of the way. Of all the states with polling discrepancies, compared to results... Wisconsin is very high on the list, with a 6.5 variance, which tends to favor republicans. Polling greatly underestimates republican support and overestimates democrat support, when compared to general election results. Having stated that, the narrow polling margin, which is slightly in favor of Trump, indicates R-256 and D-216.

That leaves 66 electoral votes to decide the election.

I haven't even gotten to North Carolina (16), which appears almost certain to fall into the R column. Now it is R-272 and D-216.

Now for Michigan (15) and Pennsylvania (19). Two states, which closely follow Wisconsin in under-reporting republican support and overstating democrat support. That both states are indicating a republican advantage, before looking at previous polling errors, it seems appropriate to throw them into the repubican slot. R-306 and D-216.

Nevada you say. Nevada (6) is currently leaning R, but previous history, indicates under-reporting democrat support. Still a slight edge for R, but very slight. Now it is R-306, D-216, and T-6.

Then there is the curious case of Minnesota (10), which has historically been polled with Rs being underestimated, and Ds being overestimated, compared to general election. That polling is currently very narrow, which could possibly be a problem for Dems.

R-306, D-216, and T-16.

There is a lot of time left to change things. Of course, there is always time to change things... until time runs out.

I will resist the temptation to post frequently, but if those EVs change, then I might jump in.

Thursday, January 4, 2024

This Week in Petroleum Summary January 4th, 2024 per EIA.GOV

This week's full report.

Latest Energy Consumption Data and A Few Ponderings About "Other" stuff!

Pump prices remain relatively steady, with consumption jumping on the weekly basis, but nearly flat... year over year. Now for the opinion s...

-

Reviewed this weeks EIA report and observed the current status of inventories. Oddly, although domestic consumption is down from last year,...

-

Today's EIA.gov report . Crude stocks up again, +7.6M barrels, from last week; Distillates up +2.7M Barrels; and Gasoline slid -1.9M b...

-

This week's full report . Gasoline pump prices rose +1.4¢ for the week, but continues below year ago levels, by -3.2¢, or -1.2%. Days...