Advance Monthly Sales for Retail and Food Services, June 2023.

Advance estimates of U.S. retail and food services sales for June 2023, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $689.5 billion, up 0.2 percent (±0.5 percent)* from the previous month, and up 1.5 percent (±0.7 percent) above June 2022. Total sales for the April 2023 through June 2023 period were up 1.6 percent (±0.4 percent) from the same period a year ago. The April 2023 to May 2023 percent change was revised from up 0.3 percent (±0.5 percent)* to up 0.5 percent (±0.2 percent).

Retail trade sales were up 0.2 percent (±0.5 percent)* from May 2023, and up 0.5 percent (±0.5 percent)* above last year. Nonstore retailers were up 9.4 percent (±1.6 percent) from last year, while food services and drinking places were up 8.4 percent (±2.3 percent) from June 2022.

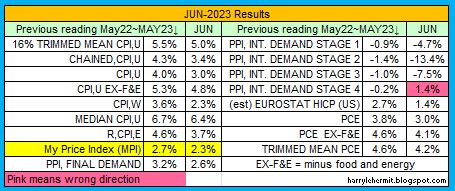

Those figures are nominal, meaning not adjusted for inflation. Compare the nominal 0.2% monthly and 1.5% annual increase... to the CPI of 0.2% monthly and 3.0% annual. In other word, the montly was flat in inflation adjusted and -1.5% on the annual inflation adjusted.

Now for the good news... maybe.

After months of the media extolling the upward trend meeting or exceeding expectations of the Advance report, they are ho-hum to disappointed in this report.

For months, I have lamented the constant downward revisions of preceding months, which gives the appearance of meeting or exceeding expectations on the Advance Report.

However, this month's advance report shows an upward revision to both April and May... from last month. Without the upward in revision in May's numbers, the uptick would have been about +0.43%. Which is still below the expectations, but not as far below the +0.5% expected.

What does appear to be happening... is the consumer is running out of steam, and has been since January. Even the FED has picked up on this. The Census Bureau acknowledges this with their XLS download (table 2).

Now the winners and losers...

Nonstore retailers is generally the mail order places, such as Amazon, etc. Furniture and electronics popped up as well as clothing.

Building materials, gasoline stations, sporting goods, and surprisingly... grocery stores slid.

As stated earlier, the spending habits are simply shifting from one thing to another, with no real growth... except inflation generated.

This graph is from data taken from the St. Louis Federal Reserve (FRED) website...

Seriously, the data from every source... indicates the party is pretty much over. It will be hard to put any type of positive spin... going forward.

Spin has been most of the business news for over a year. The realization of this condition will lead to claims of gloom and doom... which is also spin.

The past two years have not been nirvana and the outlook going forward is not bleak. At some point the spin will moderate to reality, imho.